To better understand our clients' competitive landscape, I turned to the Fortune 500 list. At first glance, you’ll notice the basics - companies, rankings, and revenues. With deeper filtering, users can browse lists based on year, sector, industry, etc. But how do we then go about discerning which industries have the greatest opportunity to gain traction – to lose traction?

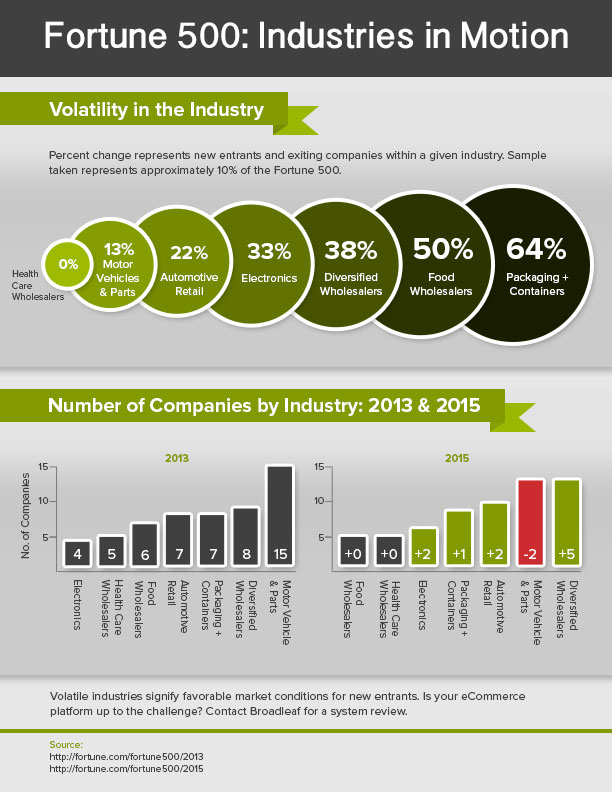

After taking a sampling of 7 different industries, the markets seemed relatively stable. Between 2013 and 2015, ‘Diversified Wholesalers’ (+5) displayed the most growth, while the largest decline was within the ‘Motor Vehicle & Parts’ (-2) industry.

Industries Sampled:

- Electronics

- Food Wholesalers

- Diversified Wholesalers

- Automotive Retailers

- Motor Vehicles & Parts

- Packaging & Containers

- Health Care Wholesalers

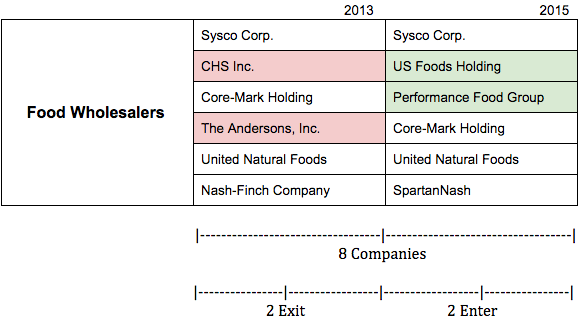

But what about ‘Food Wholesalers’? With 0% growth in industry’s overall presence in the market, how are merchants supposed to gain traction in a seemingly stable market?

Let’s take a closer look. ‘Food Wholesalers’ had 6 vendors in the top 500 in 2013, and again in 2015 – seemingly flat - but all told, only 4 vendors over the two-year period remained the same. Out of the total of 8 companies represented between 2013 and 2015, 4 experienced either coming or going from the top 500 list. Essentially, what’s beneath the surface is a 50% change in the vertical – subtly indicating favorable conditions for merchants vying for a premier position in today’s market.

Originally, this was going to be labeled ‘churn’, however most articles I glanced at referenced ‘churn’ as only the number of leaving a market, it did not account for new market entrants.

Ok, now which verticals are the most volatile? Which are the most stable?

From this sampling, the industries experiencing the most movement included: ‘Electronics’, ‘Diversified Wholesalers’, ‘Food Wholesalers’, and ‘Packaging & Containers’ – each experiencing 38% or more change in market-leading positions.

The most stable industries from this study include ‘Automotive Retail’ at 22%, ‘Motor Vehicle & Parts’ at 13%, and ‘Health Care Wholesalers’ at 0%.

The top 500 positions are full of opportunity – is your platform up to the challenge? For an eCommerce system review or to discuss how Broadleaf can help you prepare for your next commerce initiative, contact us – we’d love to chat.

Source:

http://fortune.com/fortune500/2013